There are two important factors for companies to do

- People

- Money

Therefore, the bosses of many companies in the market have learned to use equity financing” and equity incentives” to raise more funds and get more talents to join the team.

However, this method will also dilute the founder’s original shares. Many bosses can’t collect the equity that is released because they haven’t designed the equity, or they have to buy back the equity at a very high price, which makes many bosses feel bad enough.

Have you ever thought about the best time to dilute your shares? Let me tell you that there is an equity that will not dilute your shares:

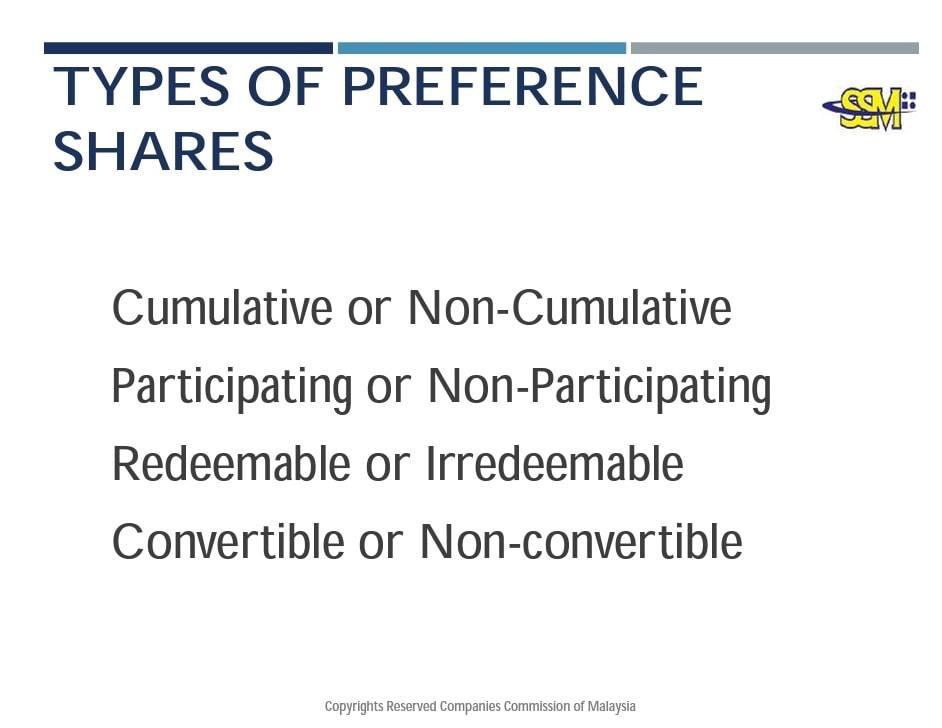

That’s the “preferred share” PREFERENCE SHARE

✅ Preference stocks are stocks with priority.

✅ Preference shareholders have priority over the company’s assets and profit distribution, and their risks are relatively small.

✅ Preference shareholders have no voting rights on company affairs.

✅ Preference shareholders do not have the right to vote and be elected.

Generally speaking, they do not have the right to participate in the company’s operation. Preference shareholders cannot withdraw their shares. They can only be redeemed by the company through the redemption clause of the preference shares, but they can stabilize the dividends.